|

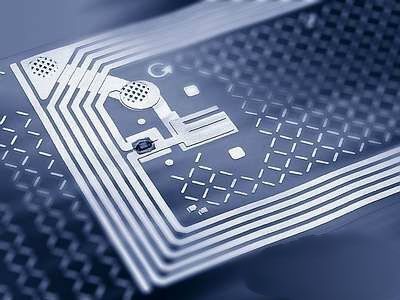

Shortage of RFID chips leads to application tension

SANRAY RFID, March 7, 2022: It is not only the RFID industry that faces the problem of chip shortage. The global chip shortage affects a variety of electronic products from mobile phones to electric toothbrushes, as well as the automotive, aircraft and game industries. The reasons range from the closure of factories based on covid-19 to poor supply chain planning, and then to the small number of manufacturers in the wafer manufacturing industry. Coupled with a series of factory fires, record end demand, as well as the recent European war and soaring energy prices. Bindiya Vakil, chief executive of supply chain solutions company, said: "now we see enterprises trying to ensure the number of chips and scrambling to build new wafer factories." At the same time, the demand for RFID Technology (including UHF and HF tags and Readers) is also growing. This situation is not expected to stop, so supply delays in the RFID industry are increasing. For example, in the first quarter of 2022, RFID technology company Impinj warned that it would be seriously affected by the shortage of wafers and would not be able to meet demand. "We are beginning to hear more and more news about the potential impact of chip shortage on RFID, whether orders cannot be met or deployment lead times are affected," said Sandeep Unni, senior executive analyst of the company, Gartner's retail research practice. "If the current situation continues, the supply is limited and the demand is still high, I think it may have a great impact on new projects later this year." On the bright side, this shortage is mainly driven by demand. Bill ray, vice president of research at Gartner, said that companies that are now struggling to cope with supply chain disruptions have in fact begun to turn to RFID to improve predictability to identify bottlenecks and understand the location of goods during transportation. This includes the retail market, as well as many other industries, such as charging, supply chain and logistics, and government projects. "Making semiconductor chips requires semiconductors," Wakil said. According to a financial report by Chris Diorio, co-founder and CEO of Impinj, IC demand exceeded shipments by 50% in the fourth quarter of 2021. This may mean that the speed of embedded manufacturers has slowed down, and they have been shutting down their production lines regularly. "We still believe that if we have more supplies, they will increase their bookings," Diorio said in his quarterly report In the first half of this year, Impinj found that the wafer supply was basically flat. The company expects that the wafer supply commitments of 200mm and 300mm (8 inches and 12 inches) will reach or exceed the shipment level in the fourth quarter by the middle of this year. "These shipments are much lower than our rapid growth in demand," odilio said. "Although our partners continue to give priority to our upstream wafers, and both of us (we) want to reduce the pressure on the process nodes we use, so far, this relief has not occurred at least, and the size does not meet our needs." The company said it had received record retail bookings despite this. According to a prediction from IDTechEx's largest wafer supplier, the supply will be limited in the next few years, and the new wafer production facilities will not be put into use until 2024 at the earliest. orginal from: http://www.huawurfid.com/doc_22977661.html |